Bangkok Bureau – Special Report

Bangkok, Thailand – May 3, 2025

Thailand’s real estate bond market, once a pillar of predictable returns and investor confidence, is now teetering on the brink of a financial earthquake—one that industry experts warn could shake the foundations of the broader Thai economy more violently than any natural disaster.

Over the past year, a series of developer defaults, stalled mega-projects, and mounting investor anxiety have exposed deep vulnerabilities in the nation’s $30 billion property-linked bond sector. Once buoyed by low interest rates and aggressive expansion, developers now face an unforgiving reality: a liquidity crunch, falling property values, and a mass exodus of retail investors.

“This is a systemic shock, not a localized tremor,” said Thanapong Suthikorn, a senior analyst at Kasikorn Securities. “We are witnessing the slow-motion collapse of trust in a market that was marketed as low-risk and high-reward. The aftershocks will hit banks, pension funds, and middle-class savers alike.”

A Perfect Storm

The crisis has been brewing for months. Bond issuers—primarily mid- and large-scale property developers—raced to the debt markets between 2019 and 2022, exploiting low interest rates and loose regulatory oversight. These bonds, often marketed directly to the public, offered yields as high as 8–10%, significantly above bank deposit rates.

But as global interest rates rose and Thailand’s property market cooled, cracks in the façade became undeniable. Sales of new condominiums plummeted by 40% in 2024, according to data from the Real Estate Information Center (REIC), while refinancing options for maturing bonds dried up. Some developers resorted to desperate measures—issuing new bonds to pay off old ones, or pledging incomplete projects as collateral.

The dam finally broke in March 2025 when Titan Property Group, a high-profile developer with over 15 billion baht in outstanding bonds, defaulted on two major repayments. The default triggered a wave of panic among retail bondholders and raised urgent questions about the solvency of at least a dozen other firms.

Government on Edge

Thailand’s Securities and Exchange Commission (SEC) has scrambled to contain the fallout, imposing emergency disclosure rules and launching a probe into alleged misstatements by several developers. Meanwhile, the Ministry of Finance has ruled out a blanket bailout, instead urging market-driven restructuring.

“We cannot allow moral hazard to take root,” Finance Minister Arkhom Termpittayapaisith said in a press briefing last week. “But we are prepared to support measures that ensure market stability and protect retail investors.”

Still, calls are growing for more decisive action. Several lawmakers have urged the Bank of Thailand to consider emergency liquidity lines for affected developers, while investor advocacy groups are demanding compensation mechanisms for misled bondholders.

The Human Cost

Beyond the numbers, the human toll is becoming painfully clear. Thousands of retirees and small investors, many of whom poured their life savings into these high-yield bonds, now face an uncertain financial future.

“I trusted the brand names. I trusted the ratings,” said Kanya Phrombut, a retired schoolteacher in Chiang Mai who invested 1.2 million baht in now-defaulted bonds. “No one told us this was gambling.”

Market analysts warn that unless confidence is quickly restored, the crisis could spill into other sectors. Construction layoffs, unfinished projects, and tighter credit conditions could drag down GDP growth and delay the country’s post-pandemic recovery.

What’s Next?

As regulators, investors, and developers brace for what could be the most severe financial shock in Thailand’s real estate history, one thing is clear: this is not a market correction—it is a crisis of credibility.

Without swift and transparent reforms, including stricter bond issuance standards, better risk disclosures, and stronger investor protections, Thailand’s real estate bond market may take years to recover, if it ever does.

“The countdown has ended,” Thanapong warned. “The quake is here. Now comes the reckoning.”

More Stories

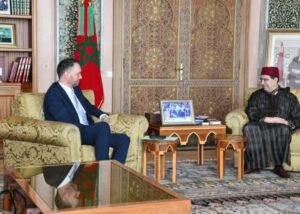

Belgium Reaffirms Backing for Morocco’s Autonomy Plan, Signals Stronger Diplomatic and Economic Engagement

Finland Backs Morocco’s Autonomy Plan as Path Toward Resolving Sahara Dispute

Morocco Reaffirms Solidarity with Gulf Allies Following Regional Tensions