A leading investment strategist has warned that escalating U.S. tariffs on Chinese goods could result in the loss of 5 to 10 million jobs in China, placing mounting pressure on Beijing to adjust its economic strategy and trade policies.

Shannon Bessent, chief strategist at Key Square Group, stated in a recent interview that the “onus is now on Beijing” to respond meaningfully as the U.S. ramps up trade pressure. The Biden administration has signaled renewed efforts to reassert economic leverage over China, particularly in sectors like semiconductors, electric vehicles, and green energy — areas where China has been aggressively expanding its influence.

“These tariffs aren’t just symbolic,” said Bessent. “They have the power to materially damage China’s labor market and manufacturing base at a critical time when the country is already facing structural economic challenges.”

According to Bessent, many of the jobs most at risk are in export-heavy industries that rely on low-cost manufacturing for U.S. and global markets. With U.S. firms increasingly seeking to diversify supply chains — moving operations to countries like Vietnam, Mexico, and India — the pressure on China’s workforce could intensify.

The estimate of 5 to 10 million jobs lost underscores the scale of potential disruption. China is already battling slowing domestic consumption, a faltering property market, and rising youth unemployment. A blow to its export sector could deepen existing vulnerabilities.

Washington’s renewed trade measures, while framed as efforts to protect American industries and national security, are also seen as a strategic move to limit Beijing’s technological ambitions. U.S. officials argue that China’s industrial policies and subsidies have distorted global markets and pose long-term risks to Western competitiveness.

In response, Beijing has denounced the tariffs as “unilateral coercion” and accused the U.S. of violating international trade rules. However, analysts believe China’s options are constrained. With an economy still recovering from the COVID-19 pandemic and facing capital outflows, a tit-for-tat escalation could be economically costly.

“China’s leadership has to make a decision,” Bessent said. “Do they take a confrontational approach, or do they recalibrate to attract more global investment and maintain stability?”

As trade tensions simmer and global markets watch closely, the economic fallout from this renewed tariff battle could shape the geopolitical and financial landscape well into the next decade.

More Stories

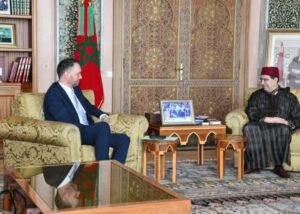

Belgium Reaffirms Backing for Morocco’s Autonomy Plan, Signals Stronger Diplomatic and Economic Engagement

Finland Backs Morocco’s Autonomy Plan as Path Toward Resolving Sahara Dispute

Morocco Reaffirms Solidarity with Gulf Allies Following Regional Tensions