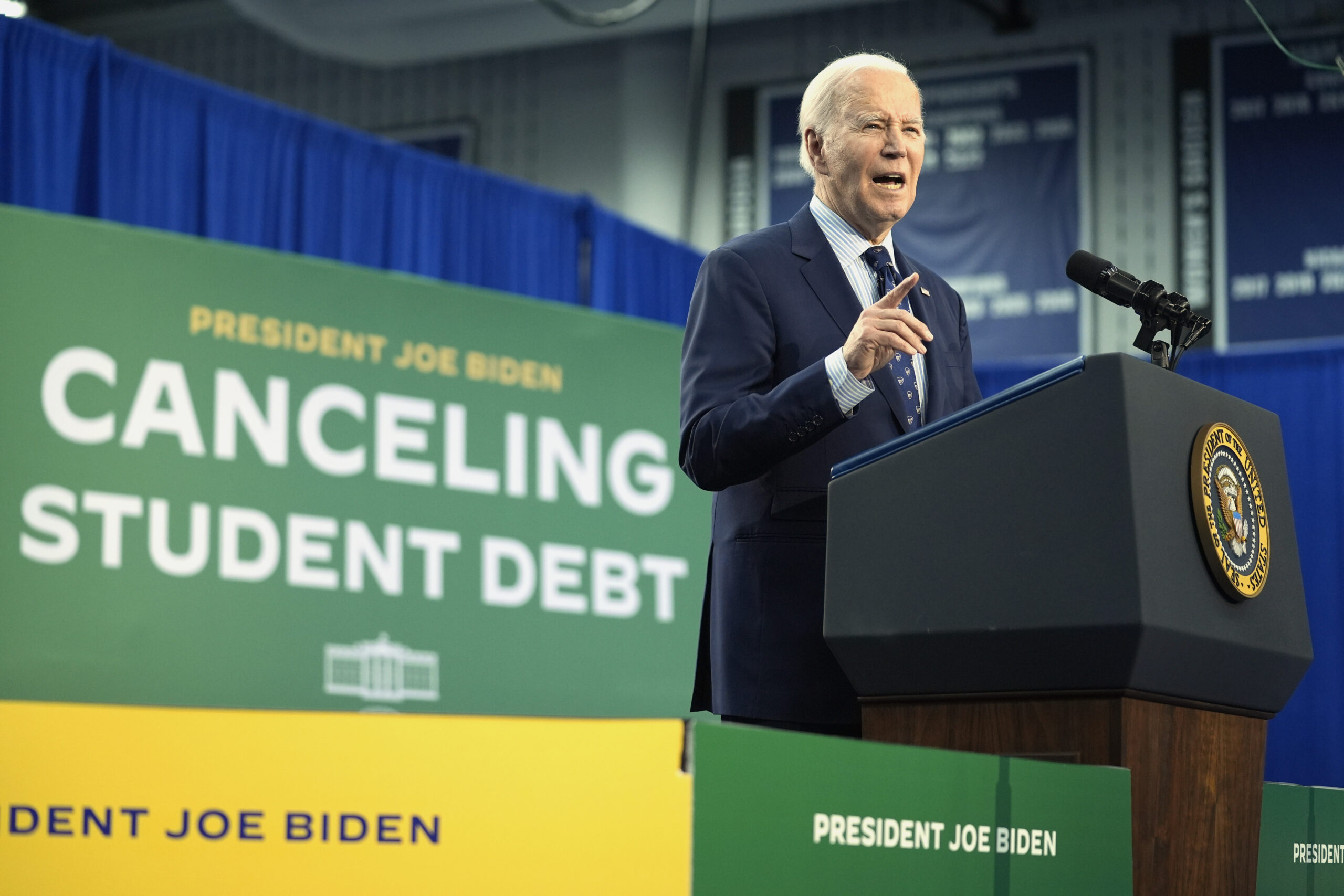

Millions of Americans burdened by student debt just got some much-needed breathing room. Thanks to a new repayment plan rolled out by the Biden administration, 8 million student-loan borrowers will not be required to make any payments for at least the next six months. This move is part of a broader effort by the White House to reform the student loan system and provide relief to those struggling with debt.

The New Repayment Plan

The new plan, known as the SAVE Plan (Saving on a Valuable Education), is designed to replace older repayment models with a more income-driven approach. Under this plan, monthly payments are tied to a borrower’s discretionary income, with many low-income borrowers qualifying for significantly reduced—or even zero—payments. Those who qualify for the zero-payment bracket will not be expected to make any payments for the next six months.

The plan also aims to provide long-term relief by reducing the interest that accrues on student loans, preventing ballooning debt amounts as borrowers try to chip away at the principal.

Why the Delay in Payments?

The six-month payment delay for 8 million borrowers stems from several factors:

- Administrative Readjustments: The Department of Education is in the process of enrolling borrowers into the new SAVE Plan. This process involves recalculating repayment amounts based on income and family size, which can take time.

- Ongoing Economic Challenges: The Biden administration is keenly aware of the lingering economic impact of the pandemic. With inflation and housing costs still high, many borrowers have expressed concerns about their ability to resume payments, which were paused for over three years during the pandemic. The additional six months provides a cushion for borrowers as the economy stabilizes.

- Preventing Default: One of the key motivations behind this plan is to prevent borrowers from defaulting on their loans. A sudden resumption of payments could overwhelm many households, leading to widespread defaults that would negatively impact both borrowers and the economy. This buffer period is seen as a way to prevent such a crisis.

Borrowers React

For millions of Americans, the announcement of another six-month payment reprieve was met with relief. One borrower, Sarah Johnson, a teacher from Ohio, expressed how vital the delay is for her family.

“After more than three years of not making payments, my family has adjusted to a different financial reality. If we had to start paying right now, it would throw our budget into chaos. This six-month delay gives us the time we need to plan,” she said.

For others, like recent college graduate Alex Hernandez, the delay is more about survival.

“I’m still looking for a stable job in my field. If I had to start paying my loans now, it would mean choosing between rent and my loan payment. I don’t think I’m the only one in this situation,” he explained.

A Broader Student Loan Strategy

The SAVE Plan is part of the Biden administration’s broader strategy to address the student debt crisis. While the Supreme Court struck down Biden’s initial plan to forgive up to $20,000 in student loans for eligible borrowers, the administration has remained committed to finding alternative solutions. In addition to SAVE, the Department of Education has launched several initiatives aimed at improving access to loan forgiveness for public servants and individuals working in non-profit sectors.

Education Secretary Miguel Cardona emphasized that the administration is still looking at other avenues to provide more permanent relief.

“We know this is just one step. We’re working to overhaul a system that has left millions of Americans drowning in debt. The SAVE Plan is a major milestone in ensuring that student loans don’t hold back borrowers from achieving their goals,” Cardona said.

What’s Next for Borrowers?

While the six-month delay offers temporary relief, borrowers should be prepared for payments to eventually resume. The Department of Education plans to continue enrolling eligible individuals in the SAVE Plan and encourage borrowers to explore their options.

Financial experts recommend that borrowers use the six-month delay to assess their budgets, create a savings plan, and ensure they are on the best repayment plan for their financial situation. With continued uncertainty in the economic landscape, many hope that this is just the beginning of deeper reforms in the student loan system.

The Biden administration’s SAVE Plan and the six-month delay in payments come as a lifeline for 8 million borrowers across the country. While the future of student loan forgiveness remains in flux, this new repayment plan represents a significant step toward easing the financial burden for millions of Americans. As Washington continues to work on broader student debt reforms, borrowers can, at least for now, breathe a sigh of relief.

4o

More Stories

“Hurricane Melissa Brings Catastrophic Wind and Rain Onto Jamaica”

Liverpool Star Diogo Jota Tragically Killed in Car Crash in Spain

Gaza Beach Café Strike Deepens Crisis, Fuels Fury