Washington, D.C., February 25, 2025 – In a closely contested vote, the House of Representatives approved a Republican budget resolution that aligns with President Donald Trump’s fiscal agenda. The 217-215 vote reflects deep divisions within Congress over proposed tax cuts and spending reductions.

Key Provisions of the Budget

• Tax Cuts: The resolution outlines $4.5 trillion in tax cuts over the next decade, including the extension of the 2017 tax cuts set to expire at the end of the year.

• Spending Cuts: It proposes $2 trillion in spending reductions, targeting programs such as Medicaid and food assistance.

• Defense and Border Security: The plan increases funding for military and border security initiatives.

• Debt Ceiling: It includes a $4 trillion increase in the debt ceiling to accommodate the proposed tax cuts and spending plans.

Political Implications

House Speaker Mike Johnson secured the necessary votes after intense negotiations, marking a significant legislative win for the Trump administration. The resolution’s passage allows Republicans to utilize the reconciliation process, enabling them to advance tax and spending legislation with a simple majority in the Senate.

However, the budget faces challenges in the Senate, where differing priorities may lead to revisions. Senate Republicans have expressed interest in larger tax cuts, which could complicate negotiations.

Reactions

Democrats have criticized the budget, arguing that it favors the wealthy and corporations at the expense of social programs. The Committee for a Responsible Federal Budget warns that the measures could add $2.8 trillion to the deficit by 2034.

Supporters contend that the tax cuts will stimulate economic growth and that spending reductions are necessary to address the national debt.

Next Steps

The resolution’s passage initiates the reconciliation process, with detailed legislation expected in the coming weeks. Lawmakers will need to reconcile differences between House and Senate proposals to enact the budget into law.

This development underscores the ongoing debate over fiscal policy and the balance between tax relief and social welfare programs in the United States.

More Stories

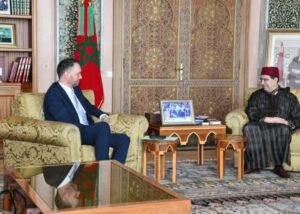

Belgium Reaffirms Backing for Morocco’s Autonomy Plan, Signals Stronger Diplomatic and Economic Engagement

Finland Backs Morocco’s Autonomy Plan as Path Toward Resolving Sahara Dispute

Morocco Reaffirms Solidarity with Gulf Allies Following Regional Tensions