The Internal Revenue Service (IRS) has announced a significant development that will bring welcome financial relief to approximately one million American taxpayers. These individuals are set to receive payments of up to $1,400 each, addressing previously unclaimed Recovery Rebate Credits from the 2020 tax year.

These payments specifically target taxpayers who were eligible for but did not receive their full Economic Impact Payments (commonly known as stimulus checks) during the height of the COVID-19 pandemic. Many of these individuals may have missed out due to filing delays, processing errors, or confusion about their eligibility status.

The IRS identified these recipients through a comprehensive review of 2020 tax returns, discovering that many eligible Americans had either not claimed the credit or had received incomplete payments. This initiative represents a significant effort by the tax agency to ensure that pandemic-era financial assistance reaches all intended recipients.

To qualify for these payments, individuals must have:

- Filed a 2020 tax return

- Met the income eligibility requirements from the original stimulus program

- Not received their full entitled payment during the initial distribution

The IRS will automatically process these payments, meaning eligible taxpayers do not need to take any additional action. The distribution is expected to begin in the coming weeks, with direct deposits and physical checks being the primary methods of payment.

Tax experts recommend that recipients who receive these payments carefully review their records to ensure accuracy, as these funds may need to be reported on future tax returns. Additionally, the IRS encourages taxpayers to keep their mailing addresses and direct deposit information current to avoid any delays in receiving their payments.

Note: Since my knowledge cutoff is April 2024, I recommend consulting the IRS website or current news sources for the most up-to-date information about the timing and specific details of these payments.

More Stories

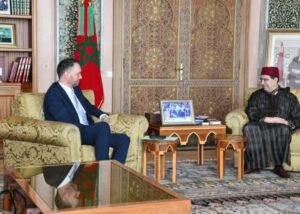

Belgium Reaffirms Backing for Morocco’s Autonomy Plan, Signals Stronger Diplomatic and Economic Engagement

Finland Backs Morocco’s Autonomy Plan as Path Toward Resolving Sahara Dispute

Morocco Reaffirms Solidarity with Gulf Allies Following Regional Tensions