In an unprecedented market reaction, Bitcoin surged past the $80,000 mark following Donald J. Trump’s recent election victory, sparking significant interest and speculation in the cryptocurrency world. Investors are viewing Trump’s return to office as a potentially transformative moment for economic and regulatory landscapes, driving Bitcoin to historic highs as confidence in digital assets grows.

The surge in Bitcoin’s price reflects a broader trend of investors seeking alternative assets amid uncertainties around traditional financial policies. Analysts attribute the rise in Bitcoin’s value to expectations that Trump’s policies could increase inflationary pressures, causing investors to turn to decentralized assets like Bitcoin to preserve their wealth. Trump’s previous term saw mixed signals regarding cryptocurrencies, with heightened scrutiny on digital assets yet a growing public and institutional interest. Now, with his victory, the market anticipates a more complex regulatory environment that could ultimately benefit Bitcoin by pushing it into the financial mainstream.

This milestone for Bitcoin has also prompted renewed excitement among retail and institutional investors alike, as major cryptocurrency exchanges reported record trading volumes following the election results. The $80,000 benchmark is seen as a significant psychological threshold, signaling growing acceptance and demand for Bitcoin as a “safe haven” asset.

Beyond Bitcoin, the broader cryptocurrency market saw a surge as well, with Ethereum and other major coins posting significant gains. The market’s reaction highlights a global sentiment shift as investors hedge against traditional financial uncertainties and consider the potential for alternative assets to shape the future economic landscape.

Bitcoin’s recent milestone not only signifies a turning point for digital currency adoption but also reinforces the asset’s position as a key player in a rapidly changing global financial environment. As the world watches the post-election impact on regulatory policies unfold, the continued rise of Bitcoin and its role in the economy will be a significant trend to monitor.

WWW.WORLDMEDIAFEED.COM

More Stories

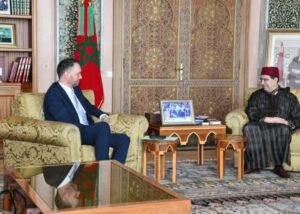

Belgium Reaffirms Backing for Morocco’s Autonomy Plan, Signals Stronger Diplomatic and Economic Engagement

Finland Backs Morocco’s Autonomy Plan as Path Toward Resolving Sahara Dispute

Morocco Reaffirms Solidarity with Gulf Allies Following Regional Tensions