Date: [02/01/2024]

In a rare display of bipartisanship, the U.S. House of Representatives has given its approval to a comprehensive tax bill aimed at bolstering economic support for families and businesses. The legislation, which enjoyed support from both Democrats and Republicans, focuses on expanding the child tax credit and providing breaks for businesses. Here’s a closer look at the key aspects of the approved tax bill:

One of the central features of the bill is the expansion of the child tax credit, a move designed to provide greater financial relief to families. The legislation proposes increasing the credit amount and making it more accessible to a broader spectrum of households, with the goal of alleviating the economic strain on parents.

Acknowledging the economic challenges faced by businesses, especially in the aftermath of the global pandemic, the tax bill introduces targeted breaks to stimulate growth. These measures are intended to incentivize investment, innovation, and job creation, with a focus on assisting small and medium-sized enterprises.

The approval of the tax bill signals a rare moment of bipartisan collaboration in a politically polarized climate. Lawmakers from both sides of the aisle expressed a commitment to addressing pressing economic issues and providing tangible relief to American families.

As the nation grapples with uncertainties stemming from the ongoing global situation and its economic repercussions, the tax bill is seen as a step toward injecting stimulus into the economy. Policymakers hope that the combination of child tax credit expansion and business incentives will contribute to a more robust recovery.

While the House has given its nod to the tax bill, the legislation now faces its next hurdle in the Senate. The degree of bipartisan support in the upper chamber will be critical to the bill’s success, and negotiations are expected as senators deliberate on its various provisions.

If the bill successfully passes through the Senate and is signed into law, American families stand to benefit significantly from the expanded child tax credit. The increased financial support is anticipated to ease the burden on parents and contribute to a more stable economic environment for households.

The business community closely watches the proposed breaks and incentives outlined in the tax bill. Depending on the final version that emerges from the Senate, businesses may see opportunities for increased investment and growth, particularly in sectors that have been adversely affected by recent economic challenges.

As the tax bill progresses through the legislative process, its potential impact on families, businesses, and the broader economy will continue to be a focal point of discussion. The bipartisan nature of this initiative provides a glimmer of hope for collaborative policymaking in addressing the nation’s economic priorities.

More Stories

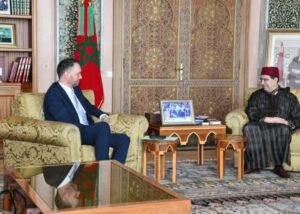

Belgium Reaffirms Backing for Morocco’s Autonomy Plan, Signals Stronger Diplomatic and Economic Engagement

Finland Backs Morocco’s Autonomy Plan as Path Toward Resolving Sahara Dispute

Morocco Reaffirms Solidarity with Gulf Allies Following Regional Tensions