Date: [01/31/2024]

In a widely anticipated move, the Federal Reserve announced today that it would keep interest rates steady, signaling confidence in the nation’s economic recovery. The decision comes as consumer confidence continues to improve, and policymakers aim to strike a balance between supporting growth and addressing concerns about inflation.

The Federal Open Market Committee (FOMC), responsible for setting monetary policy in the United States, concluded its two-day meeting with the decision to maintain the target range for the federal funds rate at its current level. The move reflects the central bank’s commitment to fostering economic stability while carefully monitoring key indicators.

Consumer confidence has been on the rise in recent months, driven by positive developments in the labor market, increased vaccination rates, and robust economic growth. This improved sentiment has contributed to stronger spending patterns, a crucial component of the overall economic recovery.

Despite concerns about inflationary pressures, the Federal Reserve has emphasized its commitment to a flexible approach that considers both short-term and longer-term economic trends. Inflation has experienced a moderate increase in recent months, primarily driven by supply chain disruptions and a surge in demand as the economy reopens.

Federal Reserve Chair Jerome Powell, during a press conference following the FOMC meeting, acknowledged the inflationary pressures but reiterated the central bank’s view that these effects are likely to be transitory. Powell emphasized the importance of a patient and data-driven approach to monetary policy, indicating that the Federal Reserve is prepared to adjust its strategy if economic conditions evolve.

The decision to keep interest rates unchanged was met with a mixed response from financial markets. While some investors expressed relief at the continuity of the central bank’s accommodative stance, others closely scrutinized Powell’s remarks for clues about the potential timing of future policy adjustments.

As the economic recovery progresses and uncertainty surrounding the global landscape persists, the Federal Reserve’s decisions will continue to play a crucial role in shaping the trajectory of the U.S. economy. Policymakers remain vigilant, ready to adapt their strategies to ensure a stable and sustainable economic environment in the face of evolving challenges.

More Stories

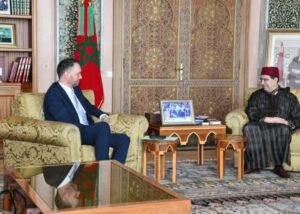

Belgium Reaffirms Backing for Morocco’s Autonomy Plan, Signals Stronger Diplomatic and Economic Engagement

Finland Backs Morocco’s Autonomy Plan as Path Toward Resolving Sahara Dispute

Morocco Reaffirms Solidarity with Gulf Allies Following Regional Tensions