In a significant development, an Italian judge has ordered the seizure of £677 million (approximately $920 million) from Airbnb as part of an ongoing investigation into alleged tax evasion by the popular vacation rental platform. This move underscores the growing scrutiny of tech companies and their tax practices by governments around the world.

The Italian Investigation:

The Italian financial police and prosecutors have been conducting an investigation into Airbnb’s tax affairs, focusing on its revenue generated in Italy. The authorities allege that Airbnb failed to report and pay taxes on a significant portion of its earnings from rentals in the country. Italian authorities suspect that Airbnb has not been properly declaring income earned by property owners who rent their homes through the platform.

The Court’s Ruling:

The recent ruling by an Italian judge orders the seizure of £677 million from Airbnb. This decision is considered a precautionary measure to secure potential tax liabilities while the investigation is ongoing. The seized amount represents an estimate of the unpaid taxes and penalties that Airbnb may owe if found guilty of tax evasion in Italy.

Airbnb has expressed its disagreement with the court’s decision and plans to appeal. The platform argues that it is not responsible for the taxes on hosts’ income, as hosts are considered independent operators under Italian law.

Global Taxation Challenges:

The case against Airbnb is part of a broader global effort to hold tech companies accountable for their tax practices. Many countries argue that these companies benefit from their local markets but use intricate international structures to minimize their tax obligations. This has led to calls for more comprehensive international tax regulations to ensure that multinational corporations, including tech giants, pay their fair share of taxes in the countries where they operate.

In this context, the Organization for Economic Co-operation and Development (OECD) is working on an international tax overhaul, known as the Base Erosion and Profit Shifting (BEPS) project, to address these issues and establish more consistent and equitable taxation rules for digital companies.

Airbnb’s Response:

Airbnb, like many other tech firms under scrutiny for their tax practices, argues that it follows tax laws in each of the countries where it operates. However, the company also acknowledges the need for international tax reform. In a globalized digital economy, the question of where and how multinational corporations pay taxes has become increasingly complex.

The outcome of the Italian investigation into Airbnb’s tax affairs will be closely watched, as it may set a precedent for other countries grappling with similar issues. As governments continue to focus on ensuring that tech companies pay their fair share of taxes, this case highlights the ongoing challenges and debates surrounding international taxation in the digital age.

More Stories

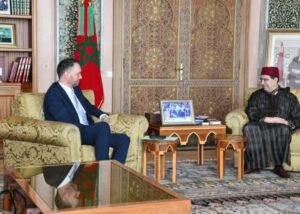

Belgium Reaffirms Backing for Morocco’s Autonomy Plan, Signals Stronger Diplomatic and Economic Engagement

Finland Backs Morocco’s Autonomy Plan as Path Toward Resolving Sahara Dispute

Morocco Reaffirms Solidarity with Gulf Allies Following Regional Tensions