In an increasingly complex economic landscape, many Americans are feeling the pinch as their household expenses surge ahead of their earnings. According to a recent AP-NORC poll, this growing disparity between income and expenses has become a concerning trend for individuals and families across the United States.

The AP-NORC Poll: Unveiling Financial Concerns

The Associated Press-National Opinion Research Center (AP-NORC) poll, conducted to gauge the financial well-being of Americans, has revealed a disheartening reality for many households. As the cost of living continues to rise, including housing, healthcare, and fuel, a significant portion of the population is finding it increasingly difficult to make ends meet.

The poll found several critical points that underscore the financial challenges facing Americans in 2023:

- Household Expenses Outpacing Income: A substantial portion of respondents reported that their household expenses have grown at a faster rate than their earnings over the past year. This has created a widening financial gap that many find difficult to bridge.

- Rising Inflation: Inflation, driven by various factors including supply chain disruptions and increased demand, has significantly impacted the cost of everyday goods and services. Respondents expressed concerns about these rising prices affecting their purchasing power.

- Housing Costs: Housing expenses, a major component of the average American budget, continue to soar. Rent and mortgage payments are causing financial stress for many, especially in cities with high real estate prices.

- Healthcare Worries: Healthcare costs, a long-standing concern for Americans, continue to be a significant financial burden. Even with insurance, the out-of-pocket expenses for medical care are a source of anxiety for many.

The implications of household expenses outpacing earnings extend beyond just individual financial stress. Families are grappling with difficult decisions as they try to maintain their quality of life. Some are cutting back on essential spending, sacrificing healthcare, or delaying major life decisions, such as buying a home.

Government Response and Policy Implications

The poll’s results underscore the need for continued government attention to economic issues, particularly those related to income inequality and inflation. The Federal Reserve and other government agencies have been closely monitoring inflation and adjusting their policies in an attempt to mitigate its impact.

Additionally, the findings may influence discussions about initiatives such as raising the minimum wage, expanding access to affordable healthcare, and addressing housing affordability challenges.

The AP-NORC poll has shone a spotlight on the financial struggles of many Americans whose household expenses are surpassing their earnings. As inflation, housing costs, and healthcare expenses continue to rise, the economic divide between those who can comfortably cover their needs and those who struggle is becoming more pronounced. This situation underscores the need for effective economic policies that can help alleviate these financial burdens, making it possible for more Americans to thrive in an increasingly challenging economic landscape.

More Stories

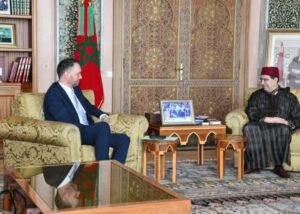

Belgium Reaffirms Backing for Morocco’s Autonomy Plan, Signals Stronger Diplomatic and Economic Engagement

Finland Backs Morocco’s Autonomy Plan as Path Toward Resolving Sahara Dispute

Morocco Reaffirms Solidarity with Gulf Allies Following Regional Tensions