As the economic landscape faces uncertainty and challenges, a number of cities in the United States are grappling with severe financial difficulties, teetering on the brink of bankruptcy. These cities are confronted with a confluence of factors that have put their financial stability in jeopardy. From unsustainable debt burdens to declining revenues and rising expenditures, their fiscal situations have become increasingly dire.

Here are 10 cities that are facing severe financial challenges, raising concerns of potential bankruptcy:

- Detroit, Michigan: Detroit’s bankruptcy in 2013 was one of the most high-profile municipal bankruptcies in history. While it emerged from bankruptcy, the city still faces deep-seated economic issues, including population decline and high poverty rates.

- Chicago, Illinois: Chicago has been grappling with a massive pension crisis, with unfunded pension liabilities that continue to mount. The city’s finances are strained by a combination of debt, pension obligations, and operational costs.

- Baltimore, Maryland: Baltimore is struggling with crime, population loss, and an eroding tax base. These issues have led to declining revenues and a city budget under immense strain.

- Cleveland, Ohio: Cleveland faces shrinking population and declining property values, which contribute to a declining tax base. These factors have created a significant financial challenge for the city.

- Memphis, Tennessee: Memphis is plagued by high poverty rates and strained public services. The city’s budget is stretched, and it’s struggling to maintain public safety and infrastructure.

- San Bernardino, California: San Bernardino filed for bankruptcy in 2012 due to a combination of issues, including excessive debt and shrinking revenues. The city has made efforts to recover but remains in a precarious financial situation.

- St. Louis, Missouri: St. Louis faces declining population and high crime rates. These factors have led to increased expenditures for law enforcement and decreased tax revenue.

- Hartford, Connecticut: Hartford’s financial struggles are driven by high debt levels, shrinking revenue, and the state’s inability to provide substantial aid.

- Newark, New Jersey: Newark grapples with a high tax burden and a lack of resources to address issues such as crime and public education.

- Oakland, California: Oakland’s financial challenges stem from budget deficits, pension costs, and increased demands for services.

The challenges facing these cities are not uniform, but the common thread is that they are all at risk of financial instability. While some have managed to stave off bankruptcy through measures like debt restructuring and financial recovery plans, their long-term fiscal health remains uncertain.

These situations underscore the need for proactive and responsible financial management in municipalities. The fiscal crises faced by these cities serve as a cautionary tale and a reminder of the importance of addressing economic issues before they reach a point of no return.

More Stories

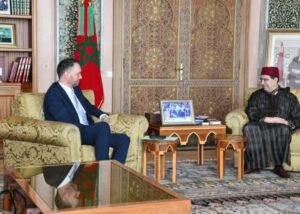

Belgium Reaffirms Backing for Morocco’s Autonomy Plan, Signals Stronger Diplomatic and Economic Engagement

Finland Backs Morocco’s Autonomy Plan as Path Toward Resolving Sahara Dispute

Morocco Reaffirms Solidarity with Gulf Allies Following Regional Tensions